Switzerland is a popular destination for both businesses and private citizens. However, companies that operate here even temporarily and private citizens who decide to move here often don’t know the obligations they need to fulfil to avoid any sanction.

That’s where our specialists step in to provide an in-depth overview of all the applicable standards and guide you step by step through your relocation to Switzerland.

Foreign companies that operate even temporarily in Switzerland need certain authorisations, which you must know in depth to avoid any problems.

- Obtaining required work permits

- Preparing pay slips

- Advice on applicable minimum wage costs

Want to open a branch in Switzerland?

If your company generates turnover in Switzerland, the law requires you to register for VAT through a tax representative in Switzerland. Mistakes and misunderstandings in this field can cause serious consequences for your business.

We can serve as a tax representative and take care of the various duties, such as registering for VAT or drawing up VAT returns. Moreover, thanks to our twenty years of experience, we can manage any dispute with the Federal Tax Administration.

Let’s meet to discuss your business in Switzerland and the tax obligations you need to fulfil.

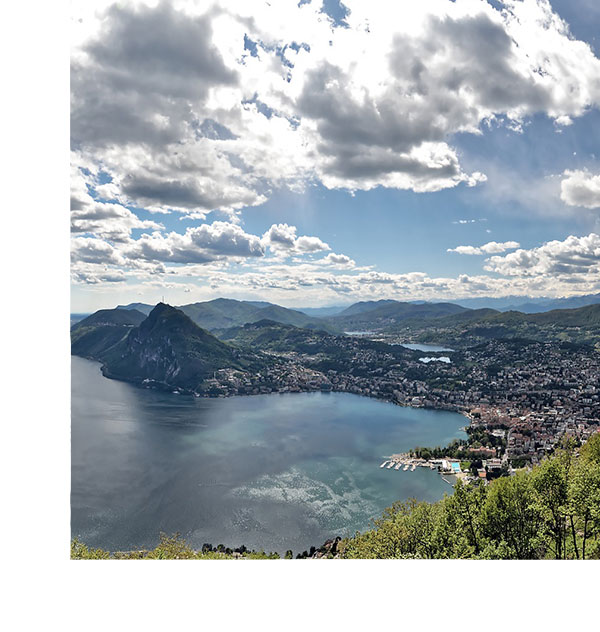

Moving to Switzerland is a great idea in more than one way. Not just because you’ll save on taxes but also, and more importantly, for the quality of life, the safe social setting, and the highly efficient services for citizens.

However, every case has its own characteristics. That’s why our trustees offer a free consultation to suggest the best formula for your relocation. Then, if you do decide to relocate, our team will assist you throughout the entire process ensuring your peace of mind.

Choosing to live in Switzerland is a great choice from both a fiscal and professional point of view. The Canton of Ticino offers plenty of job opportunities.

- We help you perform a cost/benefit analysis (personal – insurance – taxes) of a relocation to Switzerland

- We help you manage your family needs (housing – enrolling kids in school – bank accounts, etc.)

- We’ll assist you in obtaining your residence permit even without a gainful activity

- We’ll assist you negotiating the conditions of lump-sum taxation